The TCFD framework helps enterprises develop sustainably

TCFD is short for Task Force on Climate-Related Financial Disclosures. TCFD was established by the Financial Stability Board (FSB) in 2015 to promote the disclosure of climate-related financial information by companies and financial institutions, so that investors and stakeholders can better assess the risks, opportunities and financial impact of climate change.

According to the TCFD Status Report 2021, seven cross-industry indicators, including Scope 1, 2, and 3 greenhouse gas emissions, have been elevated to a high level of importance for financial impact assessment in. It can be seen that the greenhouse gas disclosure ability of enterprises could be one of the key indicators to measure the environmental and climate information disclosure of enterprises.

By publicly announcing their support for the TCFD and its recommendations, enterprises would shown that they are taking action to build a more resilient financial system through climate-related disclosures.

From now on, TCFD had been received support from more than 4,000 enterprises and institutions in 101 regions, covering almost all economic sectors. Nearly a hundred companies in China had expressed support for TCFD, such as Tencent, Geely, and the PBC as well.

What is the significance of TCFD? Why do we need to add such an aditional work apart from disclosing the financial information and ESG reports? What effects could TCFD bring to companies?

Help enterprises gain their competitive advantage. Under the guidance of global climate change and dual carbon goals, both enterprises and financial institutions must do a good job in the work of TCFD. In the "carbon peak and carbon neutral era", manufacturers and developers can explore green paths for resource utilization and energy consumption based on their own advantages, improve their competitiveness, and maximize profits. Enterprises should give full play to their own advantages and improve their competitiveness so as to maximize their utilization.

Help enterprises gain the recognization from all over the world. Climate change is now a global issue, with carbon tariffs being implemented in both the European Union and the United States. TCFD can promote the international recognition of enterprises, help enterprises establish their image and reputation in the international community, fully increase the green added value of enterprise products, break through the "green barriers", and ensure the sustainable development of China‘s economy.

Help enterprises improve their investment potential. Help enterprises seize investment opportunities in the "sustainable development era", enhance the ability of financial institutions to deal with environmental and climate risks, enhance the competitiveness of the financial industry itself, and improve overall efficiency.

Promote the increase of corporate social benefits. Consider environmental factors in investment and financing activities, reduce damage to the environment and ecology, improve resource utilization, and then fulfill corporate environmental and social responsibilities, while creating a large number of jobs in environmentally friendly projects.

When faced with climate change issues, many assets are exposed to potential risks, making risk assessment in financial markets critical. One of the fundamental functions of financial markets is to support smart and efficient capital allocation decisions by pricing risk. However, to perform this function, financial markets need accurate and timely corporate disclosures. Without the right information, investors and other interested parties may misprice or value assets, resulting in a misallocation of capital.In this regard, TCFD provides a proven set of standards that provide important support for risk assessment in financial markets. By requiring companies to disclose climate-related information, such as physical risks and transition risks, TCFD had ensured that investors and market participants could understand the climate risks and opportunities that businesses face. These disclosures enable the risk of assets to be priced and valued more accurately. Through the standards of TCFD, the financial market can better understand the strategies and plans of enterprises in dealing with climate change, thereby more accurately assessing the sustainability and long-term value of enterprises. This helps investors make more informed decisions, avoid assets that are over-exposed to climate risk, and allocate funds more efficiently to sustainable and climate-friendly projects and industries. Therefore, TCFD provides financial markets with key tools to help investors and market participants accurately assess and price climate risks of assets, thereby supporting the risk pricing function of financial markets and promoting the correct allocation of capital.

TCFD reporting is a way for companies to be transparent with investors about their climate-related risks and opportunities, in line with the needs of investors for ESG investments, to provide a better foundation for long-term value creation, to give investors a better understanding of their companies' climate-related risks and opportunities, and to better understand their strategic planning and risk management approaches.

Enterprises have demonstrated their important climate-related information and business operation methods to the public and investors, which, to a certain extent, can encourage enterprises to participate more actively in the realization of global low-carbon, environmental protection and sustainable development goals, enhance market consensus and synergies, and promote the long-term and steady development of the market.

It is helpful for regulators to form a unified standard and framework, and promote the formulation and implementation of regulatory policies. Increase the supervisory capacity of regulatory agencies on financial institutions' climate risk management and information disclosure, reduce regulatory loopholes and risks, and better supervise the stability and healthy development of financial markets.

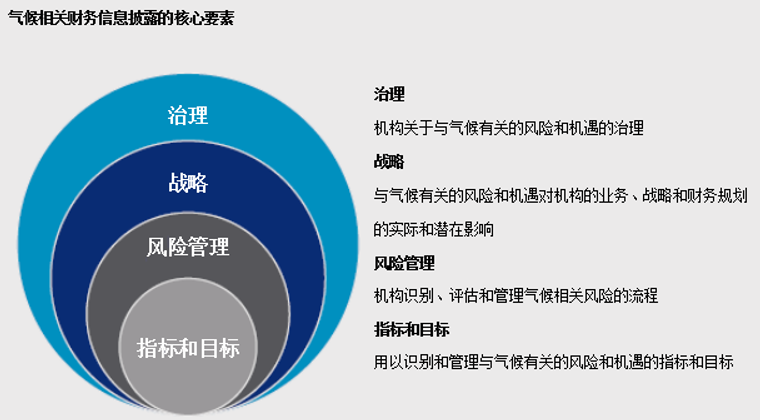

The TCFD proposed framework consists of the following four key elements: governance, strategy, risk management, indicators and targets (as shown below).Because the definition of each element in the TCFD framework is vague, it is difficult for enterprises to accurately understand its specific disclosure requirements, resulting in the framework is difficult to apply. At present, domestic enterprises have gradually realized the importance of climate information disclosure, and gradually began to refer to the TCFD framework to disclose relevant information. However, due to the difficulty of disclosure, the number of disclosure companies in China is currently small, and the quality of disclosure is not high, and most of the content is limited to a brief qualitative description of the risks and opportunities in the TCFD framework.

The TCFD proposed framework had become an important reference standard for many regulatory agencies to disclose climate change. For example, the Singapore Exchange (SGX) requires all listed companies to comply with the TCFD recommended framework for climate information disclosure;The Hong Kong Stock Exchange requires certain industries to make disclosures under the TCFD recommended framework by 2025.

In addition, TCFD proposed framework is now the climate change-related scoring standard for many rating agencies. For example, CDP has included the TCFD proposed framework in its climate change questionnaire; MSCI has released a "Report based on the TCFD proposed framework"; the Dow Jones Sustainability Index (DJSI) also uses the TCFD proposed framework as the evaluation standard for the climate strategy part.

Companies that identify opportunities and risks brought about by climate change in accordance with the TCFD proposed framework and disclose them to stakeholders can:

❖Strengthen the climate management mechanism: Help companies better identify, prevent and respond to financial risks and opportunities brought about by climate change;

❖Increase the trust of investors: Improve the transparency, predictability and stability of the market, enhance investors' trust in enterprises, and attract more investment funds.

❖ Promote sustainable development:According to the recommendations of TCFD, continuously improve enterprise management, and promote the transformation of enterprises to a more environmentally friendly and sustainable direction;

❖In addition to disclosing in accordance with the proposed framework of the TCFD, enterprises can apply to become a supporter of the TCFD through the TCFD website and be included in the supporter list on the TCFD website to demonstrate their determination to address climate change and manage related risks and opportunities to stakeholders.

Leverage joined TCFD in 2022 and was a supporter; we are committed to promote the carbon peaking and carbon neutrality development of enterprises through its professional services and influence.

Leverage is one of the 69 companies of the TCFD working group in China, and one of the few Chinese companies that has passed the verification of the SBTi science-based carbon target initiative. We will release a carbon-neutral roadmap action report in 2022. In the field of carbon peaking and carbon neutrality, we can not only provide enterprises with dual-carbon related training, but also provide carbon inventory, carbon verification, carbon footprint, carbon neutral certification, SBTi scientific carbon target setting, carbon neutral roadmap action report consultation and other services. We hope that through our professional team and services, we can help Chinese companies understand, familiarize themselves with and practice carbon peak and carbon neutral goals faster.

Leverage is a responsible third party supply chain management services company, It is a member of China National Certification and Accreditation Administration Certification body (CNCA-R-2020-707), China National Accreditation Service for Conformity Assessment Inspection and Accreditation Body (CNAS IB0605), LCA Life cycle Green Management Professional Committee, and is also recognized by many international organizations, such as UNGC, UNEP, AWS, ILO, etc., can provide customers with carbon verification, carbon inventory, carbon neutral roadmap preparation, ISO management system certification, ISO37301 compliance management system training and certification, corporate social responsibility strategy consulting, ESG report preparation and verification, ESG strategy consulting and other related services, hoping to help the realization of sustainable development goals of enterprises.

ISO management system certification | service certification | product certification | product inspection and testing services | corporate ESG strategy consulting | ESG report preparation | ECOVADIS/SBTI technical support | ESG-related capacity building | AA1000 enterprise sustainable development (EGS) report verification

If you want to know more information, please contact us:

■ Shanghai :

Leverage Limited (Shanghai) Co., Ltd.

Address: Room 402, No 2. Building, No .1328, Hengnan Rd, Shanghai, China

Phone: + 86 21 64067720

Email: cs@leveragelimited.com

■ Hongkong :

Leverage Global Limited

Address: Room 1318-19, Hollywood Plaza, 610 Nathan Road, Mongkok, Kowloon, Hong Kong

Phone: + 852 9045 0526

Email: info@leveragelimited.com

Need More Information?Please leave us a message: